Imagine for a minute that you’d not have your car to travel to and from work every day because you met with an accident and don’t have the money to repair your car until the end of the month when you receive your monthly salary – this thought is likely to make you feel a little helpless and disappointed. If this does happen to you, you’d have to look for alternate forms of commute and either ask your friends to do you a favor, carpool with a colleague you don’t really like, or take a cab to work every single day.

To avoid getting into a situation like this, it is recommended that you opt for car insurance if it isn’t already compulsory in your state or area. Keller & Associates who are renowned insurance providers communicate the importance and the significance of car insurance in every car owner’s life, and listed below are four reasons why you need car insurance.

1. You Need Car Insurance To Pay For Any Damages

In case you meet with an accident that happens to be your fault, not only would you have to take care of your own medical and car repair expenses, you’d also have to pay the medical and car repairs expenses for the other party. In case the accident is duly your fault, the other party could also claim in court for the trauma that they incurred due to you, and the legal expenses you’d have to incur would be off the roof. However, if you have car insurance, your insurance provider will take care of all expenses related to your accident and you’d not have to incur any extra costs whatsoever. We have created a handy Involved in a Car Accident? Here’s What to Do Next PDF Checklist to help you if you are involved in an accident.

2. You Need Car Insurance In Case Your Car Gets Stolen

In case your car gets stolen, your insurance provider instantly offers you compensation to help you purchase another car. Certain insurance providers also have investigation teams that work with your local police department to find your stolen car while offering you the replacement you deserve. However, you need to check with your insurance rep that you selected the theft option while getting car insurance. Also, if you live in a state or area that has a high percentage of car or vehicle theft rates, your insurance provider is likely to make it compulsory for you to avail the theft option in your car insurance.

3. You Need Car Insurance In Case of a Fire Hazard

While your insurance provider can do little to prevent a fire hazard, they can certainly compensate you in case of damage incurred through a fire. While this may seem like an unlikely scenario, fire hazards and damages are very common and can happen to anyone. We went to bed one night, woke up the next morning, and our car had completely burned up inside. The outside was fine, but apparently, an electrical fire started and we were unaware of it until the next morning.

Hence, it is recommended that as a car owner, you take necessary precautions and avail car insurance to protect yourself financially in case of such a hazard. Additionally, if you live in a country or an area that is prone to natural fires such as bush fires, your insurance provider is likely to already have fire hazards as a major concern in your car insurance.

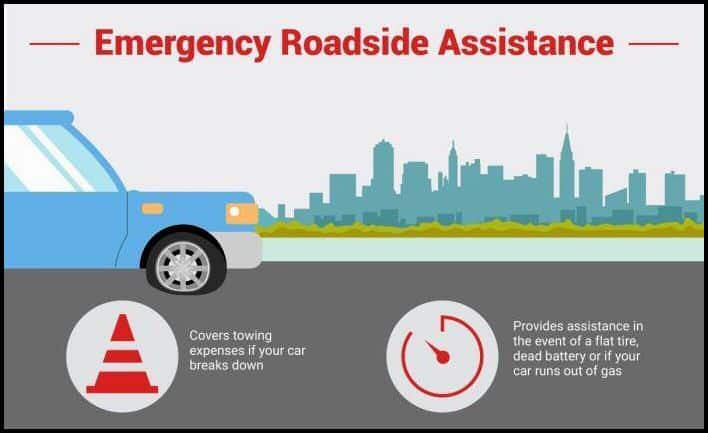

4. You Need Car Insurance to Receive Extra Perks

Since the industry of car insurance is extremely competitive, insurance providers often offer extra perks to their customers such as roadside assistance and perks for good driving. Roadside assistance typically includes services when you are on the go and incur an issue. For instance, in case you get a flat tire or run out of gas in the middle of nowhere and your insurance provider offers roadside assistance, you can simply ask your rep at the insurance firm to arrange help for you. Some insurance providers also offer premium discounts in case of good driving history through tracking apps or cashbacks.