The majority of parents will want to ensure that their kids are set up for a good future. There are ways you can emotionally enrich your children’s childhood and education so that they can grow up into well-rounded human beings. This will certainly give them a good base for them to start their adult life. However, there are some other investments that you should make for your young children. And they are all financial.

Not sure which financial investments are the best ones for your children? Here’s a complete list of all the ones you might want to think about. Don’t worry if you can’t afford to save a lot of money for your children – every little will help, and even the smallest amount you can put aside today will grow and make big returns ready for them in the future.

BANK DEPOSITS

One of the simplest ways to invest in your children’s futures is to open a bank account in each of their names. These days, most banks will let you open up an account in a child’s name as long as you can present the birth certificate. There isn’t an age-limit usually, and you should be able to open the account as soon as they are born. You can then set up a regular weekly or monthly transfer from your main bank account into your children’s. Even if you just save a few dollars each month, this should add up to a nice little amount over the next few years. Plus, the added interest can help the cash in the accounts grow further.

PREPAID TUITION

Depending on where you live, you might be able to set up some prepaid tuition plans. When you take out these kinds of plans, you will pay your child’s tuition fees in advance at the current rates. And that way, you are protecting your child against any future hikes in the cost of tuition. Another advantage of taking out this kind of plan is that it can be used at any school or college. So, whether your child goes to Harvard or Yale, you will be able to fund their tuition with these great plans.

YOUR WORK’S COLLEGE SAVING PLAN

As well as taking out a prepaid tuition plan, you can really help your children by opting into your employer’s college saving plan. The majority of large companies and businesses now give all of their employees the chance to put some of their earnings into a college saving plan. This gives you the chance to automate your saving for the kids’ college tuition, so you will end up saving without even realizing it. Not sure if your company have these kinds of plans available? If you don’t know, you should ask the HR department. If your company don’t offer this option, there might be something similar available. For instance, some businesses have scholarships for their employees to send their children to prestigious universities with.

TRUST FUNDS

When it comes to trust funds, you and your partner can be made legally responsible for the money that is paid into it on behalf of whoever’s name the fund is in. So, in this instance, you would set up a trust fund in your child’s name, and you and your partner would then be legally responsible for it. A good example of this would be stash review. That is, of course, until your child reaches the age at which you agree to release the funds to them. Most parents set this age at either 18 or 21. Your trusts don’t have to just include money, though. You can actually place any type of asset within the fund. For example, if you have a piece of land, you can place this in the fund so that your children will own it when they are older. Money, real estate, and stocks and shares can also be placed in these types of funds.

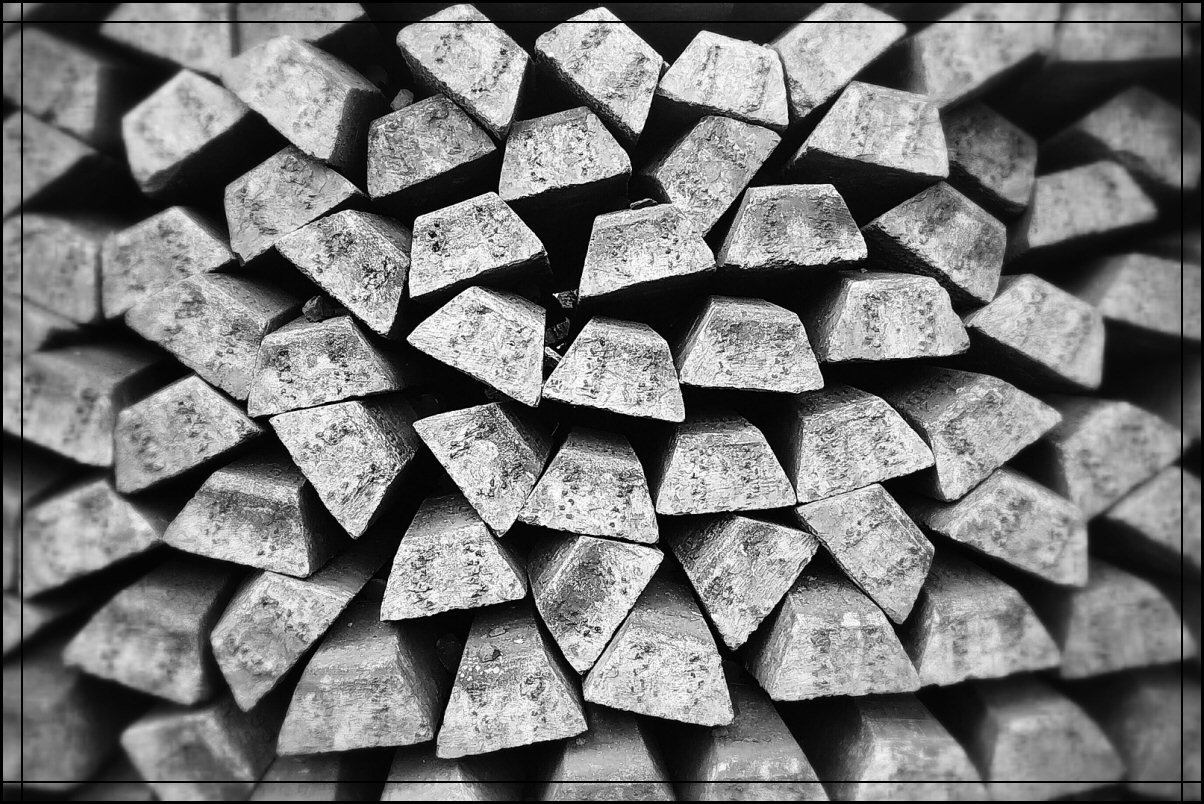

PRECIOUS METALS

Another great investment is precious metals. These kinds of metals, such as gold and silver, are often seen as a very safe investment as there is never much uncertainty in the markets. So, that means you can invest your money and be relatively sure that it won’t ever depreciate too much in value. But one of the best things about when you buy gold or get silver online is that you can buy attractive pieces to display. For instance, you might want to buy a commemorative silver coin for your child. This is still a solid investment, just like buying shares in silver or a gold bar, as the value of the silver used in the coin should, hopefully, increase over time.

STOCKS AND SHARES

It’s also worth thinking about investing in some stocks and shares for your children. However, it’s always worth bearing in mind that these can be quite risky as the stocks and shares market is usually fairly volatile. Even though you might be able to make some big returns in a short space of time, you can also lose quite a lot of cash very quickly too. But, if you are willing to take the risk and know your stuff about the stock market, then you could make quite a sizeable sum for your kids!

ANTIQUES

Another investment option is antiques. This includes antique furniture and artworks. It’s a good idea to research which antique pieces are worth buying as then you will be in a better position to buy something which will increase in value rather than lose value. If you aren’t too sure which antiques are worth buying, you might want to get in touch with an antiques dealer. They will have a good idea of how the market is currently doing, and can advise you on the type of price you should pay for certain items. Remember that sometimes, you can often find some really good deals at auction houses.

Investing in your children’s future can give them the best financial start to their adult life. And using some of the above investment suggestions can really help you get started!